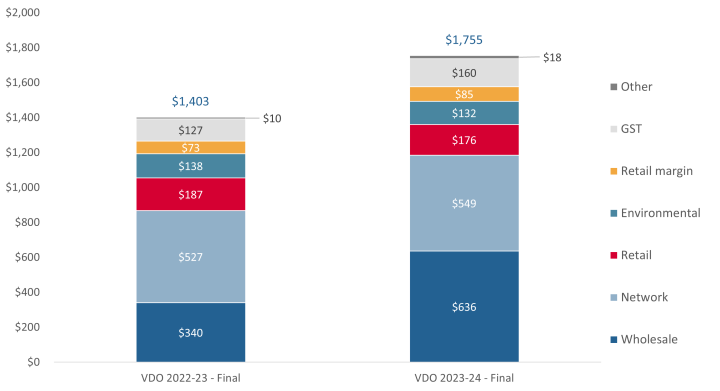

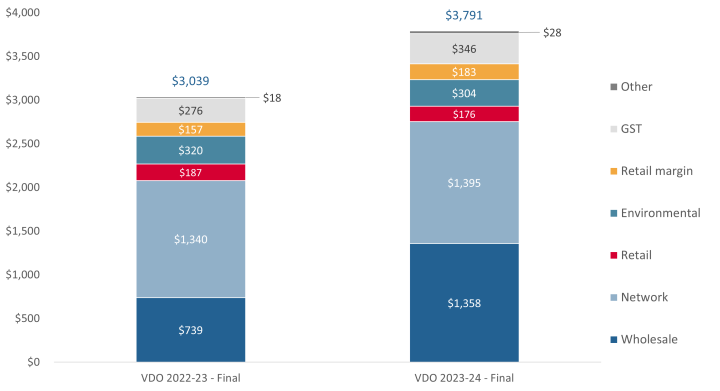

We have set the Victorian Default Offer prices to apply from 1 July 2023 to 30 June 2024. Average annual bills for default offer customers will go up by about 25 per cent. This is due to a large increase in wholesale electricity costs.

Victorian Default Offer price review 2023-24

- Consultation paper08 December 2022

- Submissions close30 January 2023

- Draft decision paper15 March 2023

- Public forum30 March 2023

- Consultation closes11 April 2023

- Final decision paper25 May 2023

- New prices in effectJuly 2023

Overview

We are responsible for setting and annually reviewing the Victorian Default Offer prices. The default offer is designed to be a simple, trusted and reasonably priced electricity option that safeguards customers that are unwilling or unable to engage in the market.

We have made our final decision on the Victorian Default Offer prices to apply from 1 July 2023 to 30 June 2024.

Victorian Default Offer 2023-24: Final Decision

Fact sheets

How cost benchmarks and annual bills will change under our final decision

Victorian default offer prices to apply from 1 July 2023 to 30 June 2024

Fixed flat tariffs for general usage and general usage + controlled load usage – residential customers (including GST)

|

Distribution zone |

Supply charge |

Usage charge structure |

Usage charge (not controlled load) |

Usage charge: controlled load |

|---|---|---|---|---|

|

AusNet Services |

$1.3251 |

Block 1 (up to 1020 kWh during a quarter) |

$0.3851 $0.3955 |

$0.2869 |

|

CitiPower |

$1.1525 |

Anytime |

$0.2871 |

$0.2271 |

|

Jemena |

$1.1438 |

Anytime |

$0.3252 |

$0.2639 |

|

Powercor |

$1.3002 |

Anytime |

$0.3292 |

$0.2559 |

|

United Energy |

$1.0814 |

Anytime |

$0.3174 |

$0.2466 |

Fixed flat tariffs for general usage – small business customers with consumption less than 40 MWh per year (including GST)

|

Distribution zone |

Supply charge |

Usage charge structure |

Usage charge |

|---|---|---|---|

|

AusNet Services |

$1.3251 |

Block 1 (up to 1020 kWh during a quarter) |

$0.4155 |

|

CitiPower |

$1.3434 |

Anytime |

$0.2834 |

|

Jemena |

$1.3057 |

Anytime |

$0.3307 |

|

Powercor |

$1.4275 |

Anytime |

$0.3062 |

|

United Energy |

$1.2405 |

Anytime |

$0.3028 |

Two period time of use tariffs – residential customers (including GST)

|

Distribution zone |

Supply charge |

Peak usage charge |

Off peak usage charge |

Usage charge: |

|---|---|---|---|---|

|

AusNet Services |

$1.3251 |

$0.4932 |

$0.2869 |

$0.2869 |

|

CitiPower |

$1.1525 |

$0.3719 |

$0.2441 |

$0.2271 |

|

Jemena |

$1.1438 |

$0.3925 |

$0.2710 |

$0.2639 |

|

Powercor |

$1.3002 |

$0.4265 |

$0.2772 |

$0.2559 |

|

United Energy |

$1.0814 |

$0.4120 |

$0.2665 |

$0.2466 |

Two period time of use tariffs – small business customers with consumption less than 40 MWh per year (including GST)

|

Distribution zone |

Supply charge |

Peak usage charge |

Off peak usage charge |

|---|---|---|---|

|

AusNet Services |

$1.3251 |

$0.4268 |

$0.2537 |

|

CitiPower |

$1.3434 |

$0.3428 |

$0.2230 |

|

Jemena |

$1.6800 |

$0.3687 |

$0.2308 |

|

Powercor |

$1.4275 |

$0.3950 |

$0.2373 |

|

United Energy |

$1.2405 |

$0.3728 |

$0.2336 |

Our price determination covers all types of standing offers including those based on time-of-use, demand and flexible tariff structures.

If you're not sure which distribution zone you're in, you can look it up on your electricity bill or view more information on the Victorian Government's energy website.

Key facts from our final decision

Our method to calculate the default offer is generally the same

Our final decision uses generally the same approach as our Victorian Default Offer 2022-23 decision. This will lead to average annual bills increasing by about 25 per cent for domestic and small business customers.

High wholesale costs are driving higher electricity prices

The increase in prices is mainly due to significant increases in wholesale electricity costs. These costs would have been even higher in the absence of the Australian Government's Energy Price Relief Plan. Wholesale electricity costs in our final decision are 87 per cent higher for residential customers and 84 per cent higher for small business customers than those in the 2022-23 Victorian Default Offer cost stack. This reflects a year of price volatility in energy markets, which makes it more expensive for energy companies to buy and supply electricity across Australia.

Support is available

If you’re residential customer, and you’re having trouble paying your energy bills, you are entitled to assistance from your retailer. Don’t delay, contact your energy retailer as soon as possible to get help. Talk to your retailer about what concessions, rebates, utility relief grants or payment plans might be available.

The commission will continue to use our full suite of regulatory tools to support and promote energy retailer compliance with critical safeguards in place to protect Victorian energy consumers. We are monitoring how retailers are meeting their responsibilities to inform energy consumers about whether they are receiving the retailers' best offers. We remain focused on promoting retailers' obligations under the energy payment difficulty framework to provide assistance to customers experiencing bill stress. Under the Energy Retail Code of Practice, a customer is entitled to receive payment assistance when they miss paying an energy bill.

How we calculate the Victorian Default offer

We are required to base the Victorian Default Offer on the efficient costs of the sale of electricity by a retailer. In doing so, we take into account:

- wholesale electricity costs – based on the price of electricity costs in the futures market

- network costs – taken directly from tariffs approved by the Australian Energy Regulator

- environmental costs – taken from public information on the costs of environmental initiatives

- retail costs – based on historical cost data

- other costs – taken directly from published reports from industry bodies

- network losses – taken from the Australian Energy Market Operator and electricity distributors

- retail operating margin – based on a benchmark from comparable regulatory decisions.

In our final decision we have made several changes, relative to past decisions, on how we calculate the Victorian Default Offer prices.

Wholesale costs

In our consultation paper we proposed to keep using the same approach to wholesale costs as we had in previous decisions. In response to the consultation paper, some retailers indicated that not accounting for options contracts might make our estimate of retailers' wholesale costs inaccurate.

In our draft decision we proposed to use the trade weighted average price of contracts from all days over the past twelve months, except the days options are exercised. We have also done this in our final decision.

Following consultation on our draft decision and further investigation of retailers' contracting behaviour, for our final decision we have removed peak swap contracts from our wholesale cost benchmark. This better reflects retailers' actual approach to building their hedgebooks. For 2023-24 this will slightly decrease our wholesale cost forecast (relative to what it would have been if we used our previous approach).

Retail Operating Costs

In our draft decision we based our retail operating cost benchmark on Victorian retailer cost data for 2020-21. For our final decision we updated the benchmark to reflect costs reported by retailers for 2021-22. In our past Victorian Default Offer decisions we used a 2017 benchmark of retail operating costs from the Independent Competition and Regulatory Commission. Using cost data from Victorian retailers better reflects the costs retailers face in Victoria and any productivity gains they may have made since 2017.

Retail Operating Margin

In our draft decision, we proposed to keep using the same approach to retail operating margin as we had in previous decisions. We set the margin at 5.7%. For our final decision, we reduced the margin to 5.3% after considering stakeholder submissions and reconsidering the evidence before us. This better reflects current market conditions.

Impact of the Australian Energy Market Operator’s June 2022 market intervention

In June 2022, the Australian Energy Market Operator took steps to stabilise wholesale electricity prices. Market participants incurred costs as a result. In our consultation paper we sought stakeholders' views on whether and how these costs should be reflected in the Victorian Default Offer.

Our draft decision was that these market intervention costs are efficient costs of the sale of electricity by a retailer. Our final decision maintains this position. As a result, market intervention costs will be passed through in the 2023-24 Victorian Default Offer. Compared to the 2022-23 Victorian Default Offer, this results in a $3.2 increase in annual bills for residential customers and $8 increase in annual bills for small business customers.

Next steps

Victorian Default Offer 2023-24 prices will come into effect from 1 July 2023.

Resources

Submissions to our draft decision paper

View our public forum on the 2023-24 Victorian Default Offer draft decision

Our public forum on 30 March 2023 provided an opportunity for interested stakeholders to express their views and raise questions about our proposed next steps for the Victorian Default Offer.